私は出会いが少ないため、女性の出会いはBARだと決めています。

そこで、多くの出会いを経験しました。

その経験を元にBARで女性と仲良くなる方法とするべきでないことについて分かりますか?

私は出会いが少ないため、女性の出会いはBARだと決めています。

そこで、多くの出会いを経験しました。

その経験を元にBARで女性と仲良くなる方法とするべきでないことについて分かりますか?

BARでナンパしたい!

男の1つの夢ですよね。

ここでは、女性がBARにいたときにどのようにしてナンパしたら良いか考えてみましょう。

BARでの声の掛け方が分かれば出会いに困らなくなります。

女性とあまり話した機会がない人ほど、何を話したらよいだろう??

なんて気になってしまいます。

そんなとき、効果のある会話術を学びたいと思いうはず。

ここではBARで使えるとっておきの会話法とルールについて解説していきます。

(さらに…)

ナンパは居酒屋とBARどちらでもやることができます。

しかし、ここではあえてBARでナンパすることをお勧めします。

なぜなら、BARの方が女性もナンパに応じやすいからです。

居酒屋もBARもどちらもお酒を飲むという点では共通ですが何が違うのでしょう?

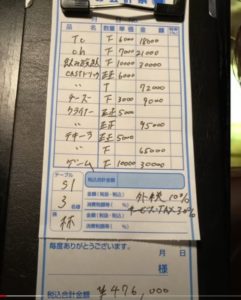

BARで出会いを探してて注意してほしいことがあります。

それは、ボッタくりのBARが存在するという点です。

こういったお店に入ってしまうと、1回で10万円掛かってしまうなど、

とんでもない金額になります。

そのため、ボッタくりのバーに入らないお店について考える必要があるのです。